By Ryan McNeill and Duff Wilson

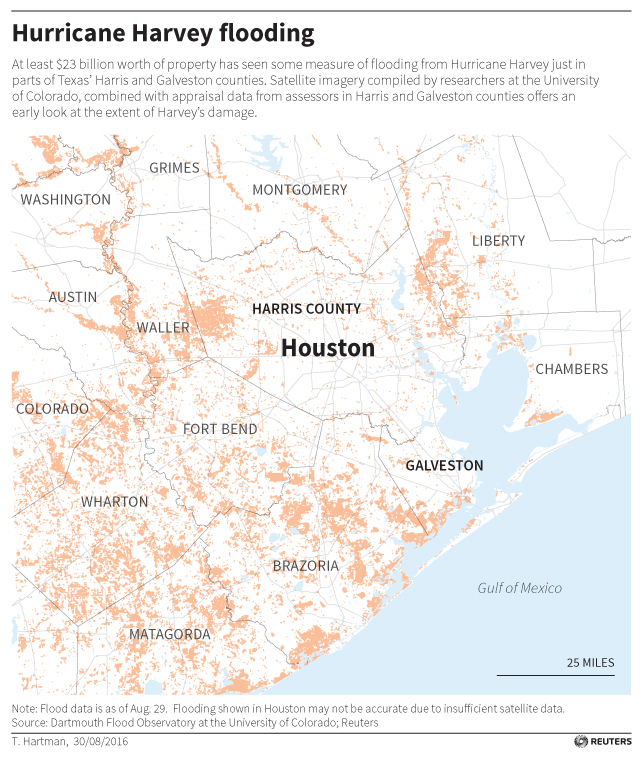

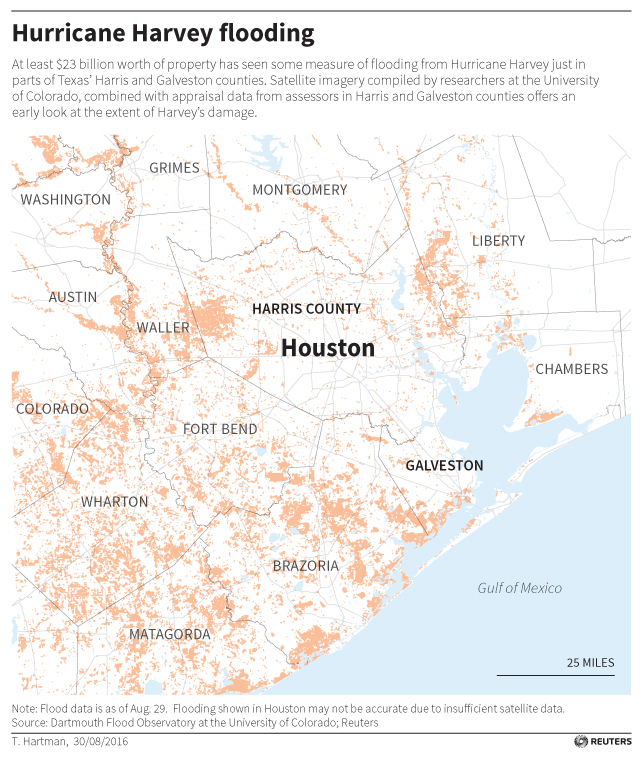

(Reuters) – At least $23 billion worth of property has been affected by flooding from Hurricane Harvey just in parts of Texas’ Harris and Galveston counties, a Reuters analysis of satellite imagery and property data shows.

The number represents market value, not storm damage, and is but a small fraction of the storm’s reach, as satellite images of the flooding are incomplete. Satellite imagery compiled by researchers at the University of Colorado shows flooding across 234 square miles (600 sq km)of Harris County and 51 square miles (132 sq km) of Galveston County, about one-eighth of each county’s land area.

It is impossible to discern damage amounts from the data, as the satellite imagery does not reveal the depth of the floodwaters; nor does it reveal the impact of wind. But even this partial tally signals that the storm will rank among the most damaging in U.S. history.

Reuters overlaid the flood imagery on property parcel maps and found floodwaters had encroached on at least 30,000 properties in the two counties, with a total market value of $23.4 billion.

Of that, 26 percent is land value; the rest is buildings and other improvements. In Harris County, where Reuters was able to determine the property’s use, about 18 percent of the affected property is residential.

The tally omits much of Houston’s dense urban center because a satellite specializing in urban imagery has not yet taken enough images there. Floodwaters have inundated the area, like surrounding regions, and thousands of homes are damaged. Many roads, including vital highways and parkways, were submerged and businesses flooded and shuttered.

Ultimately, storm damage totals will come from estimates of insured and uninsured losses and disaster assistance payments, not from tallying property assessment values.

And real estate is only part of the equation in the rapidly rising toll as Harvey moves from Texas to Louisiana. Federal damage estimates will also include the vast cost of business interruptions, ruined vehicles and other personal possessions, repairs to roadways and other public infrastructure, and disaster aid like the money used to feed and house tens of thousands of displaced people.

Adam Smith, a lead scientist for the federal agency that compiles storm damage costs, said it is “very possible” Harvey’s costs may surpass the record $160 billion from Hurricane Katrina.

“But it will take some time to understand the magnitude of Harvey’s devastation, which is still unfolding,” Smith said in an email Wednesday to Reuters. “It is very unclear if Harvey’s costs will ultimately surpass Katrina. However, since this is an unprecedented extreme precipitation event over a major city, in addition to the damage to other cities (and) regions from wind, storm surge and flooding, it’s very possible.”

Hurricane Katrina in 2005 caused about $160 billion in damage, Hurricane Sandy in 2012 caused $70 billion, and Hurricane Ike in 2008 caused $34 billion, according to research by the National Oceanic and Atmospheric Administration. The damage figures are adjusted for inflation to 2017 dollars.

Harvey, a category 4 storm with 130 mph winds, came ashore Friday in Rockport, Texas. It churned slowly over the next five days, dropping about 50 inches of rain on Harris County, more than any tropical storm recorded in the continental U.S. since 1950.

Rob Moore, a senior policy analyst for water issues at the nonprofit Natural Resources Defense Council, said it’s “anybody’s guess” how much damage Harvey has wreaked.

“Because of the extent of flooding, a lot of insurance companies are expecting to see very high numbers of complete losses of residential properties,” said Moore, who monitors government and insurance industry reports. “And large proportions of those properties are going to be uninsured. A lot of people have dropped flood insurance policies the last few years.”

Homeowners who live outside the 100-year-flood hazard zone or don’t have mortgages are not required to buy flood insurance. Because there hasn’t been major flooding in Houston in 16 years, many homeowners have dropped coverage to save money.

Asked what would happen to them, Moore said, “They’re left in a situation nobody wants to be in. They’re not going to have very many options for repairing their homes. And a lot of forms of federal disaster assistance aren’t available if you don’t have flood insurance.”

Many of the neighbors who returned Wednesday to Oak Knoll Lane in Northeast Houston find themselves in that predicament. One of them, Valerie Stephens, 32, abandoned her house on Saturday, when about nine inches of water rushed into the house over half an hour. She has no flood insurance, and she said her house, valued at $79,000 on Zillow just before the storm, is worth “much less than that” now.

Up and down the street, water had topped mailboxes and left behind puddles of dirty water, a festering stink and a faint line of grime inside each house where the water had stagnated, usually a couple of feet off the floor.

That’s much less water than some areas have reported, but it was enough that residents began piling furniture on the curb and ripping open walls and floors to stop mold from creeping in and making the situation even worse.

Many did the same thing in 2001 after Tropical Storm Allison swamped the street.

“We’ve already pulled out the doors, the door frames. Then we’ll start with the sheetrock and the floors,” Stephens said. She expects to live with concrete floors and bare sheetrock while she finds the money to pay for all the damage.

(Reporting by Ryan McNeill and Duff Wilson in New York; Additional reporting by Peter Henderson and Ernest Scheyder in Houston; Editing by Janet Roberts and Marla Dickerson)